Electronic tax decisions downloaded by 24,000 flat-rate entrepreneurs already

The Conference on the modernization of the flat-rate taxation system, organized by the Government of Serbia, NALED and USAID, was held today at the Dialogue Laboratory, and there it was said that 24,000 flat-rate entrepreneurs had already downloaded the decision. About 95,000 flat-rate entrepreneurs have recieved tax decisions on the amount due for taxes and contributions for 2020, which have been submitted to their tax inbox via the eTax application.

Along with the tax decision, they also received an example of a completed payment slips in their inbox, and the deadline for payment of the January obligation expires on February 15th. The first step for those who have not yet downloaded the decision is to install the application from the Tax Administration website and obtain a qualified electronic certificate. The decision on behalf of the entrepreneur can be downloaded by an accountant or other persons with a certificate they authorize through a PEP form to be submitted at one of the branches of the TA.

- This is undoubtedly one of the most important reforms we have implemented in the last few years in terms of creating a favorable business environment. We have created a system that is completely predictable, transparent and objective. The reform improves business conditions, helps us fight corruption and the shadow economy. We introduce efficiency and simplicity in business. This alone will save Serbia's economy hundreds of thousands of euros a year - said Serbian Prime Minister Ana Brnabic.

Director of the Tax Administration Dragana Markovic pointed out that the introduction of decisions for flat-rate entrepreneurs in electronic form is a continuation of the improvement of electronic services of the Tax Administration. The introduction of the new flat-rate taxation system has significantly simplified the procedure and added value to the relationship between the Tax Administration and taxpayers.

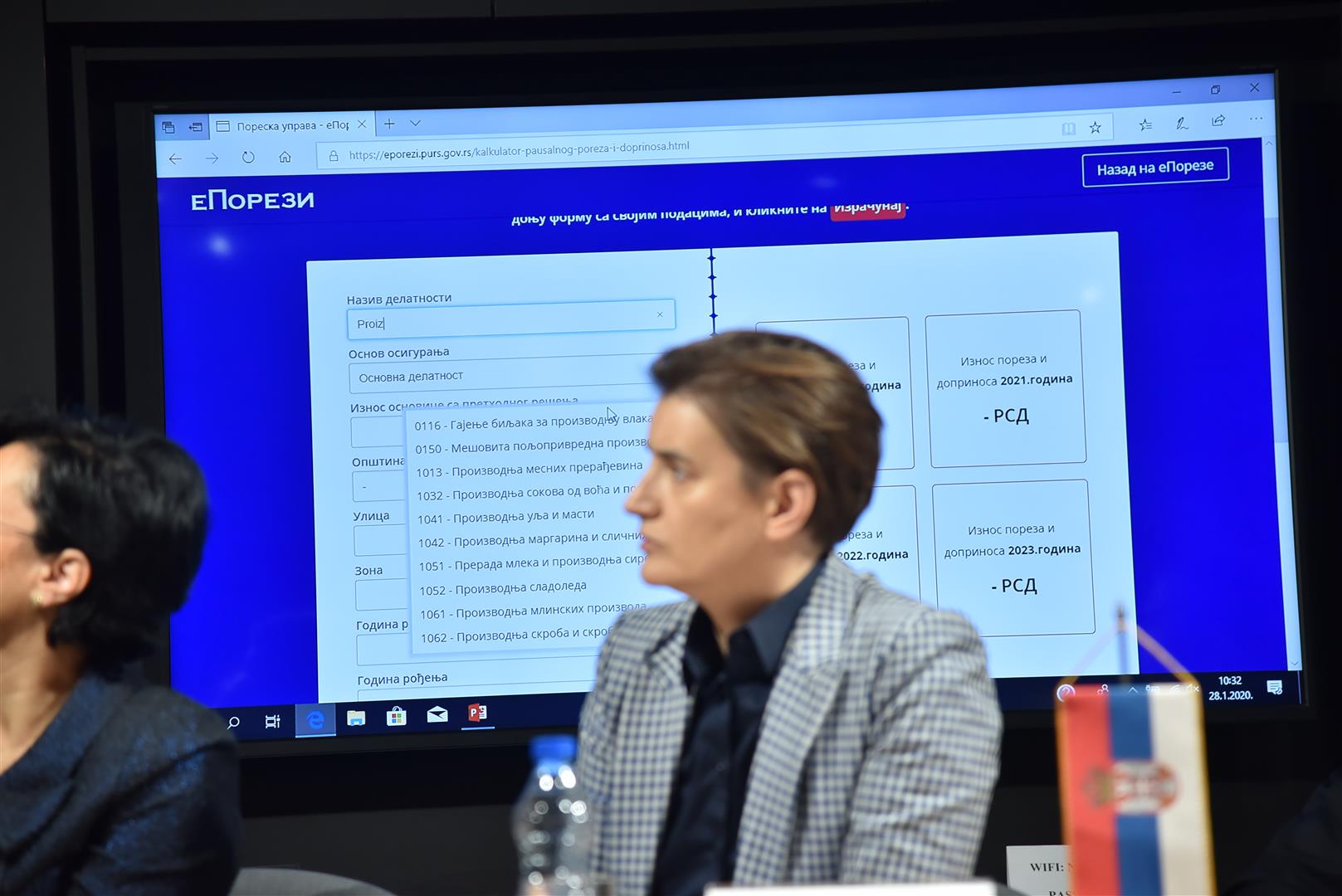

NALED Supervisory Board Chairman and PwC Serbia Director Vladislav Cvetkovic pointed to the innovativeness of the new system because everything is done electronically and there is no longer any writing nor delivery of paperwork nor possible delays. For the first time, an objective formula for tax calculation has been introduced and flat-rate entrepreneurs can calculate tax liabilities on the www.jpd.rs website for four years in advance on an indicative calculator developed by NALED in cooperation with the Tax Administration. The possible tax increase is limited to up to 10% per year until 2023.

Flat-rate taxation automation is supported by the USAID-funded Public-Private Dialogue for Development Project, implemented by NALED and the Public Policy Secreteriat of the Republic of Serbia.

With tax cuts for new businessmen under 30 and over 55, as well as for new mothers, pregnant women, persons with disabilities and old crafts, the reform also anticipates less bureaucracy in registering. Newly established flat-rate entrepreneurs will not have to file a tax return and flat-rate tax claim, and will receive a tax settlement within 48 hours.