NALED announced the best reforms of the year and presented the Grey Book 12

The new edition of the Gray Book can be downloaded here.

The new electronic flat-rate taxation system, the abolition of tax returns for a more efficient registration of property rights in the cadaster and the introduction of a simplified procedure for hiring seasonal workers are the three Best Reforms of the Year that NALED chose, for which special team honors have been awarded to public administration employees responsible for their successful implementation.

The special honors were presented at the 12th annual Conference on Economic Reforms, at which NALED presented the twelfth edition of the Grey Book, with 100 recommendations to ministries, local governments and other relevant institutions for reducing bureaucratic barriers to doing business in Serbia. The fact that 17 recommendations of the Grey Book have been implemented, which is the best result in the last five years and 40% more than the previous edition is evidence that 2019 was a successful year for reforms.

- The dialogue between the public and private sectors, government and civil society, and the openness of the government to that dialogue is one of the key things for the rapid development that Serbia needs so much. It is essential that we carefully look at the recommendations listed in the Grey Book, listen to problems and analyze the recommendations on how to solve them - said Prime Minister Ana Brnabic.

NALED Executive Board President Dejan Djokic emphasized that through the Gray Book, NALED identifies problems, proposes solutions and, with the support of international organizations, works together with institutions to implement these reforms. Out of the 241 recommendations that have gone through all Gray Books, as many as 118, that is every other one, have fully or partially found their way to the legislation. The key support for the implementation of reforms for a better business environment was provided by the EU Delegation, USAID, the British Good Governance Fund and the German GIZ.

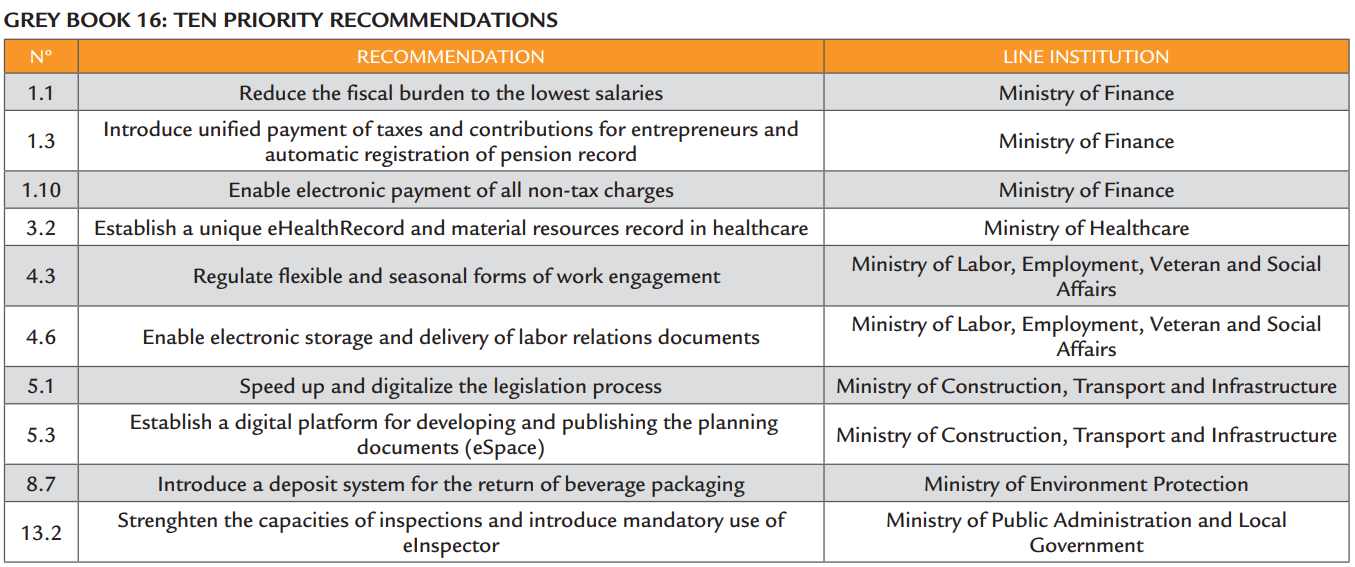

- In the Grey Book 12, we are bringing 27 new recommendations and especially highlight 10 priorities for 2020, including, in particular, reducing taxes and contributions on salaries, improving and expanding the fiscal system, establishing a public register of non-tax levies, expanding the scope of laws for seasonal workers, developing the eAgrar system for electronic registration of agricultural holdings and allocation of subsidies, and abolition of the obligation to prove transportation costs - said Djokic.

The conference highlighted that the Ministry of Finance and the Tax Administration were the most successful in resolving the recommendations of the previous issue of the Grey Book. Over the past year, an electronic system and an objective formula for automatic flat-rate taxation have been developed that introduce cost predictability for more than 100,000 entrepreneurs. The next step is to introduce the ability to consolidate tax payments into one instead of four accounts.

Last year, the oldest Grey Book recommendation was resolved and electronic tax certification was issued, which is now free of charge. This year, NALED's recommendation is for that same decision to take effect for certificates issued by local tax administrations. With the abolition of tax returns, a new procedure for registering rights in the real estate cadastre has been completed, which in practice will mean two more counters less for citizens and the economy and savings of around €24 million over the next four years. In 2019, an electronic system for seasonal employment in agriculture was launched - the new procedure allowed the number of registered seasonal workers to be increased from 3,500 to 26,600 in the first year. During the 820,000 days of their employment, taxes and contributions of 250 million dinars were paid for them, and the new system was used by 311 employers. Due to the great success of this reform, the recommendation of the Grey Book 12 is to extend this system to other seasonal jobs, such as home assistance.

Among the resolved recommendations is the introduction of eArchiving. Thanks to the Ministry of Culture and Information, after 120 years, Serbia has passed the Law on Archival Material, which will free the economy from multimillion costs of renting a warehouse and keeping paper records and allowing it to be digitized and archived electronically.

Special team honors for contributing to the reforms

Special honors for the Reforms of the Year were awarded to public administration employees who, in collaboration with NALED, did the most for the 2019 business environment.

The team consisting of Director of Tax Administration Dragana Markovic, Assistant Minister of Finance Dragan Demirovic, Svetlana Jovanovic (Cabinet of the Prime Minister of Serbia) and Dragan Agatunovic (Tax Administration) were recognized for the reform of the flat-rate taxation system.

The reform of the registration of property rights and the elimination of tax returns were carried out by Jelena Deretic and Ana Djilas (Ministry of Justice), Danka Garic (Republic Geodetic Authority), Ljiljana Petrovic (Ministry of Finance) and Violeta Nififorovic (City of Belgrade).

For the success of the employment reform of seasonal workers in agriculture, a team of IT staff working on software development and system integration were awarded: Sasa Dulic and Dragoslav Glisovic (Tax Administration), Dejan Ignjatovic (Central Registry for Compulsory Social Insurance) and Milan Djuretanovic (National Employment Service).

On The 12th annual Conference, NALED traditionally awarded a special honor for contribution to quality reporting on economic reforms, which went to Editor-in-Chief of Politika daily newspaper, Zarko Rakic.