Grey Book

For the full decade, the Grey Book contains 100 most significant recommendations by businesses, local government and civil society organizations for the regulatory framework improvements and decreasing / eliminating the administrative obstacles to doing business in Serbia. The Government institutions use the Grey Book as one of the main document for preparation of public policy documents and implementation of regulatory reforms, as each of the administrative obstacle is precisely described and argued and the proposal of the solution is provided.

Since it was first published in 2008, the Grey Book has seen 16 editions and presented 329 new recommendations for improving the business environment. Out of this number, 90 have been fully resolved (27%), and 79 partially resolved (24%), meaning that more than half of recommendations have reached the policy makers.

In 2024, only 2 recommendations were implemented and were partially resolved. This result is the worst since NALED created the Gray Book, and it is especially worrying that it comes after the very successful previous 6 editions, which each had 12 or more implemented recommendations.

The new edition of the Gray Book 17 contains 9 new recommendations for the Government of Serbia and 91 updated and improved proposals from the previous year. As last year, we kept our focus on the obligations in the process of accession to the European Union. We have selected as many as 23 recommendations to which we have awarded the "EU badge", in order to additionally highlight the reforms whose resolution will contribute to Serbia's faster path towards the European Union.

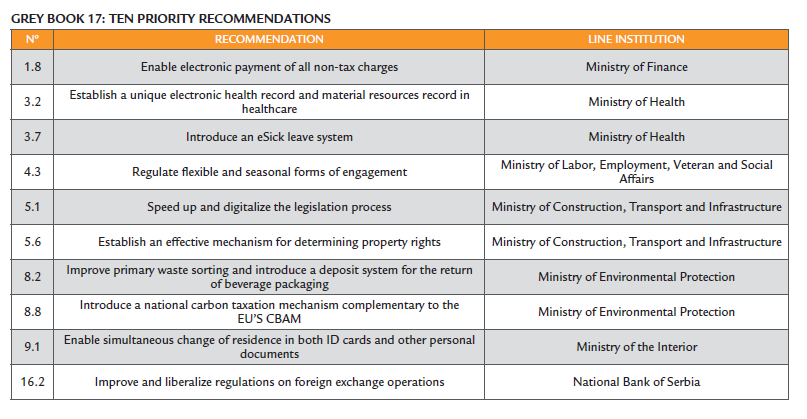

In the Gray Book 17, ten priority recommendations for the competent institutions are singled out, which are aimed at electronic payment of levies, digitization of healthcare, digitization and acceleration of procedures, abolition of unnecessary levies, environmental protection and recycling, as well as improvement of the business environment, foreign exchange operations and flexibility on the labor market.

The first steps

The Grey Book came into existence in 2008 as a result of NALED’s desire to assemble all segments of society and encourage them to engage and contribute to the common goal – building a better business environment by eliminating redundant and obsolete administrative procedures. No initiative before or after the Grey Book had dealt systematically with the administrative and practical problems faced by businesses on a daily basis, which led to Grey Book being accepted by institutions as a strategic document in planning policy reforms.

Late in May 2008 the public was introduced to the „Out of the Maze“ campaign NALED initiated together with USAID and B92 TV station. Citizens and businesses were invited to nominate complicated procedures and propose models of improvement. During June, NALED received as much as 245 justified proposals, 55 of which earned their place in the first issue of the Grey Book. Three citizens were prized for their proposals for improving the procedures of TIN assignment, construction permitting and tax filling.

Key Results

The Grey Book is responsible for elimination of some of the proverbial bureaucratic barriers. Based on NALED’s initiative, to name a few examples, the wage tax and social security contributions are now paid to a single account instead of 12 different accounts, the institutions no longer require that an excerpt from public records is not older than six months, the employment booklets are no longer used, the health insurance card are verified automatically, and the construction permitting procedures have been significantly improved. New businesses obtain a tax identification number (TIN) in BRA in a much easier fashion and if they are micro or small enterprises they are exempted from the signage fee. Pregnant women and new mothers no longer need to collect dozens of different original documents and certified copies to exercise the right to allowance during pregnancy and maternity leave, new employees are now registered electronically via online portal of the central registry of compulsory social insurance (CRCSI) and businesses do not need to provide a seal to open a bank account and conduct a payments. A unique place for the registration of property in the cadastre through the eCounter was established, which decreased the number of institutions that buyers need to go, while the procedure of property tax claim for citizens and businesses has been simplified. The implementation of the new Law on Fiscalization and the Law on Electronic Invoicing (the two long-standing recommendations of the Grey Book) will have a positive effect on reducing the grey economy, but also on the work of businesses. The whole procedure of buying and selling the used motor vehicles among the citizens has been relieved and simplified for the calculation and payments of the tax on the transfer of absolute rights, electronic payments of fees and levies for the services provided by the Ministry of Interior, without providing a proof of payments was enabled, the Central Register of Real Owners in food manufacturing has been digitalized, all of which represents the realization of the initiatives and policy reforms proposed by NALED in the previous years. In the previous five years the tax burden on net wages has been decreased by 2 percentage points (from 63% to 61%).

Related Content

Medicine-related debts exceed 100 million euros

The major part of the debt has been incurred due to medicines delivered through centralized public procurement system ...Read more

E-Agriculture

Instead of visiting various counters, the software provides household proprietors with e-accounts on the Agrarian Payments Directorate web...Read more

Electronic public procurement

The share of public procurements in our country's GDP in 2018 was only 8%, while the EU's average is 14%....Read more

Electronic archiving of documentation

The significance of e-document for businesses is not only measured in unnecessary funding allocated for toners and paper...Read more

Align the prices of utility services for citizens and businesses

The law prescribes that various categories of consumers must not be treated...Read more

The Top Reformer award goes to Minister of Finance Siniša Mali

10.03.2023

Minister of Finance Siniša Mali is the Reformer of the Year for 2022....Read moreNALED announced the best reforms of the year and presented the Grey Book 12

11.02.2020

The new electronic flat-rate taxation system, the abolition of tax returns for a...Read moreNALED has presented the new edition of the Grey Book

23.02.2022

The Grey Book features 21 new recommendations, including the introduction of...Read moreNALED presented the Grey Book and 100 recommendations for better business conditions

23.02.2021

Establishing an electronic health record, improving the water treatment system...Read moreTax certificates just a click away

The appeal for enabling electronic issuance of tax certificates has been one of the longest-lasting Grey Book recommendations (since 2009)...Read more

Grey Book 11 presented

01.02.2019

During 2018, state institutions have fully or partially resolved 12 out of 100 Grey Book recommendations. The new edition contains 100...Read moreLump-sum taxation reform

The cornerstone of the new system will be the new software and precisely defined criteria for determining the amount of tax ...Read more

Grey Book of Healthcare

20.02.2020

Siva knjiga zdravstva Srbije nastala je po uzoru na najpoznatiju i najuticajniju NALED-ovu publikaciju – Sivu knjigu propisa, koja je...Read moreLower the salary taxes and contributions

High tax burden to salaries is highlighted by businesses as the most significant cause of shadow economy and the greatest burden to business...Read more

[Ekonometar] 100 bureaucratic procedures abolished over a 10-year period

14.05.2019

NALED has been providing recommendations for cutting the red tape to the...Read more[RTS] NALED has presented the 14th Grey Book

01.03.2022

The new edition of NALED's Grey Book has 21 new and 79 existing recommendations for reducing bureaucracy and improving the business...Read moreThis website uses cookies to ensure the best user experience. By continuing to browse the site, you consent to the use of cookies.

CONTINUE LEARN MORE