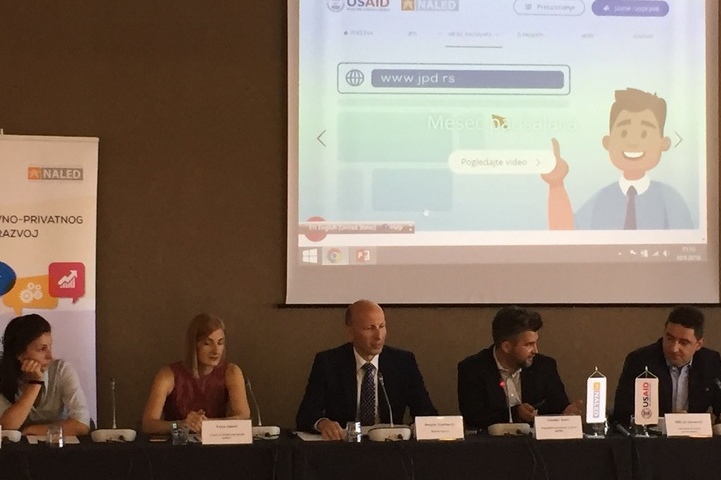

The first round table within the campaign Lump Sum Taxation Month

The first out of four regional round tables within the public campaign Lump Sum Taxation Month was held in Belgrade on Monday, 10 September, with the aim to identify the challenges and offer possible solutions for improving the lump-sum taxation system in Serbia through public-private dialogue. The event brought together representatives of Tax Administration, National Public Policy Secretariat, NALED, business associations, and individual entrepreneurs interested in this reform.

Within the event, the participants noted some of the main challenges of lump-sum taxation - the uncertainty in getting approval of the lump-sum taxation status, imprecise criteria and large room for subjectivity in the work of tax inspectors in determining the amount of tax, the delayed issuing of tax decisions, extensive administration, obstacles to exercising the right to healthcare and pension and disability insurance.

Dušan Vasiljević from NALED said that there are between 20,000 and 30,000 new entrepreneurs registered every year, with a large number of them starting out in the lump-sum taxation regime. Even though the number of lump-sum taxpayers is less than a half of all entrepreneurs, they generate more than a half of taxes, which testifies to the significance of this taxation system.

Dragan Agatunović from Tax Administration stressed that the communication between this institution and taxpayers is becoming better and better year after year, that over the past couple of years their major focus was to enable electronic submission of tax applications. Given that this service has so far been available for businesses, the Tax Administration now focuses on communication with entrepreneurs, and they are open to hear all useful suggestions in the process of developing services for this group. According to Agatunović, one of the goals is to develop an application which would ease the work of Tax Administration and the issuance of a large number of tax decisions for lump-sum taxpayers.

In Serbia, there are currently more than 116,000 registered entrepreneurs working in lump-sum taxation system, covering six different categories - from taxi drivers, lawyers, IT experts, through shoe repair shops, beauticians, hairdressers, to food industry and old crafts.

“We are aware that there is no ideal solutions for everyone, but it is important to nurture this initiative of engaging all interested parties in a public private dialogue, to start the discussion which would generate proposals for improving the lump-sum taxation system for the benefit of all categories of entrepreneurs. The goal is to ease their work, foster new entrepreneurs, stimulate self-employment among youth, women entrepreneurs and other categories. Today's round table is the first in a series that will follow, while the dialogue on lump-sum taxation will last hroughout September, and we wish to hear recommendations by entrepreneurs from various categories,” said Milivoje Jovanović, President of Association for the Development of Entrepreneurship.

The campaign Lump Sum Taxation Month is organized within the four-year Public Private Dialogue for Growth Project, financed by the U.S. Agency for International Development (USAID), and implemented by NALED in cooperation with the National Public Policy Secretariat.

The following round tables on improving the lump-sum taxation will be held in Niš (18 September), Novi Sad (21 September) and Belgrade (25 September, focusing on IT industry).

Join the dialogue and propose your ideas for improving the lump-sum taxation system via www.jpd.rs.