The tax burden on minimum wages could be reduced by a third

The tax burden on the minimum net salary in Serbia is 57%, which means that for every 100 dinars, the employer must set aside another 57 dinars for tax and contribution obligations. Last year, that expenditure was 18,200 dinars for a 32,000 dinars wage. To achieve greater relief, the taxation model needs more changes. For example, increasing the non-taxable part of the salary to the minimum wage level would reduce the obligations to 15,900 dinars, while the abolition of health care contributions would reduce the cost to 12,700 dinars, i.e. by more than 30% compared to the current amount.

This was shown by the analysis "Labor taxation system and possible reform directions", which will soon be presented by NALED, along with an overview of options for reducing the tax burden on wages in favor of workers and employers. In this year's survey on shadow economy, most business representatives (49%) cited high taxes and contributions as the biggest problem they face. More than three-quarters see them as a key cause of informal business.

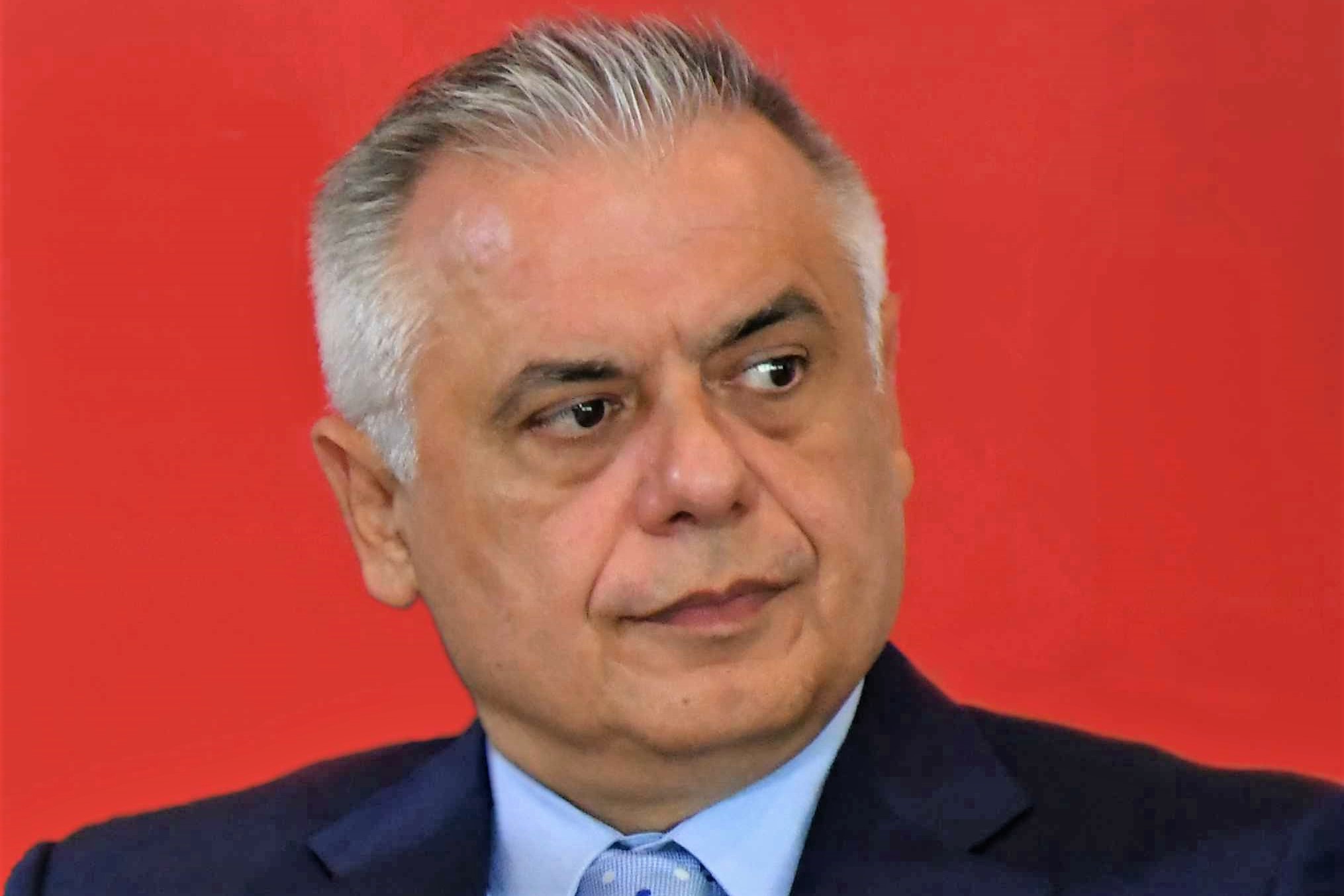

- The labor taxation system is very complex, and that is why we should first focus on tax relief for the lowest salaries, which are highly taxed in Serbia, in comparison to other countries, since our system is at a low level of progressive taxation. This would open space for increasing wages and reducing informal work arrangements. According to existing estimates, between 350,000 and 400,000 people, or every fifth employee, receive the minimum wage - says Dušan Vasiljević, Director for Competitiveness and Investments at NALED.

According to the Statistical Office of Serbia, the average net salary in our country for August was slightly more than 75,000 dinars, while the median net salary was 57,911 dinars, meaning that 50% of employees received income lower than that amount.

According to Vasiljević, there are several ways in which tax relief can be significantly affected, from increasing the non-taxable part of wages, changing the wage tax rate, which has been reduced from 14% to 10% in the last decade and a half, to reducing the base for calculating individual or of all contributions (for PIO, health, and unemployment). We should also consider the possibility that the workload is not only considered at the level of the employee but that dependent family members are also considered. It is precisely at this level of analysis that the high level of fiscal burden on wages in Serbia is most visible in comparison to comparable countries in the region, as pointed out by the Fiscal Council.

- NALED's proposal is to go in the direction of abolishing contributions for health care and switch to state financing from the budget, which would ensure that all citizens would have health insurance. In the analysis, we will provide several possible variants for the realization of this idea, with a calculation of how to compensate for the loss of income based on this contribution - says Vasiljević.

The labor taxation system in Serbia is set up so that, formally, part of the obligations is borne by the employee and part by the employer, but in practice, all obligations are paid by the employer. While the contribution obligations are shared by the employee and the employer, the income tax is, at least on paper, the responsibility of the employee.

NALED's analysis shows that from 2014 to 2021, the non-taxable part of earnings has increased significantly (the most in 2018 and in last year). While the total rate of taxes and contributions charged to the employee did not change from 29.9%, considering that in that period the contribution for PIO increased by one percentage point while the health contribution decreased by the same amount. There was a relief in the part of obligations borne by the employer, primarily thanks to the abolition of the unemployment contribution (0.75%) in 2019 and the reduction of the pension contribution by 0.5 percentage points in 2020. The total relief in this period amounted to only 1.25 percentage points.